Author:zhou, ChainCatcher

Farcaster co-founder Dan Romero(dwr) recently announced that the platform will undergo a major strategic adjustment, officially abandoning the "social-first" path it has adhered to for the past 4.5 years and instead embracing a growth model driven by "wallet-core".

It is reported thatFarcaster was initially positioned as a decentralized social network where developers could build novel social networks. It is an open protocol that can support many clients, just like email. Users will always be free to move their social identities between applications, and developers will always be free to build applications with new features on the network.

Dan Romero stated that under the social-first strategy, the platform released a fully functional version of the protocol, which is sufficiently decentralized and allows multiple independent teams to build and integrate on it. However, data proved that despite tremendous efforts, the social-first strategy ultimately proved unsustainable.

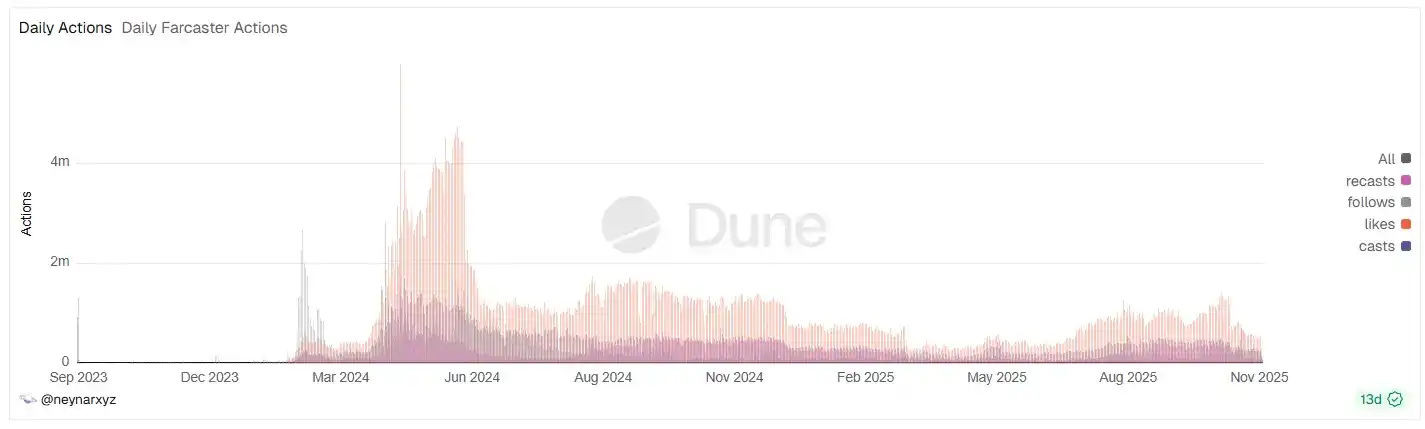

In early 2024, boosted by the Frames feature and the DEGEN airdrop, daily active users (DAU) surged from around 2000 to 100,000, and registered users exceeded 350,000, with a monthly growth rate once exceeding 400%.

However, the peak lasted less than three months. Starting from September 2024, the data plummeted:DAU fell back to around 60,000, monthly active users decreased by 40% month-on-month, and daily new user registrations dropped from a peak of 15,000 to just a few hundred.

Entering 2025, the situation continued to deteriorate. Social-side daily activity once dropped by nearly 40%. It wasn't until October, when the USDC deposit 10% reward activity was launched, that the overall daily activity was pulled back to the range of 50,000 to 60,000 by relying on wallet functions.

At the same time, the protocol's revenue also plummeted: by October 2025, monthly revenue fell to about $10,000, the lowest level in four months, a drop of about 99% from the peak.

Facing this harsh reality,Dan Romero admitted that it has always failed to find a sustainable growth mechanism for a Twitter-like social network.

Therefore,Farcaster's decision to pivot this time is a pragmatic choice, no longer pursuing a pure social narrative but instead betting resources on the rapidly growing wallet function: use the tool (wallet) first, then build the network (protocol).

The team observed that the wallet function launched earlier this year in the App expanded rapidly and is the module that has come closest to product-market fit in their five years. The new user flow has been redesigned: user registration - wallet top-up - using the wallet, with wallet top-up and tool usage as activation points.

Dan Romero concluded that every new, retained wallet user is a new user for the protocol. As users commented,SocialFi is a combination of Social and Finance, and combining it with a wallet is the real beginning.

At the product level, the core goal ofFarcaster's official application Warpcast has shifted to building an excellent wallet, focusing on expanding the intersection capabilities of wallet and social.DWR believes that adding a wallet to a social network is easier than adding a social network to a wallet. This integration is achieved through Farcaster Mini App, which are lightweight Web applications based on the Farcaster protocol and can be seamlessly integrated into clients like Warpcast.

At the same time,Farcaster is also actively deploying financial infrastructure:

- Asset Issuance: By acquiring the token issuance platform Clanker,Farcaster has equipped its wallet-core strategy with asset issuance capabilities and now holds 1.8% of Clanker's total supply.

- Financial Incentives: In October, launched the USDC deposit activity offering an additional 10% reward, directly accelerating the conversion of users into on-chain asset holders through financial incentives.

At the content level,Frames(interactive mini-apps) are the form in which Mini App is displayed in the information flow and are the key hub for realizing the mechanism of"content as transaction". Users can directly complete financial behaviors such as minting, trading, and payment within the information flow. Each interaction directly drives the use of the built-in wallet. This model transforms Farcaster from an information consumption field into a value circulation field, accelerating the financialization process of the ecosystem.

Of course, this strategic pivot is based on Farcaster's strong resource foundation and elite team background. The platform has gained favor from top institutions including Paradigm,a16z, andUnion Square Ventures. In the 2024 Series A funding round, it raised $150 million at a valuation of $1 billion. In terms of the team, co-founders Dan Romero(former VP of Operations at Coinbase) and Varun Srinivasan, as well as developer ecosystem lead Linda Xie(early employee of Coinbase) and other core members, have deep Coinbase backgrounds. Meanwhile,Coinbase Ventures also participated inFarcaster's early seed round financing.

However, this pivot is accompanied by industry skepticism about "maximalist decentralization". Well-known crypto researcher CM believes thatFarcaster's shift to a wallet route and abandonment of the social-first strategy means that the last dream of SocialFi has also ended, and the entire Crypto field seems to have returned to the 2017 ICO era where "trading and issuance" were the main themes.

Other comments pointed out thatFarcaster's early products had issues like low usability and slow Android system login, and criticized it for making some pragmatic decisions that did not please decentralization maximalists regarding decentralization and user experience.

Dan Romero clearly stated in his post that this does not mean the protocol has become a casino.Farcaster protocol is still an open system, and developers are free to choose to use the parts they find most useful. The official application (Warpcast) has simply chosen to focus on the "intersection of wallet and social", while other clients like Uno,Recaster, andCura are taking different approaches.

That is to say, if users disagree with this direction, they can choose to use other clients, build their own client, or consider another social network.CM also added that theoretically, building other clients is possible, but it is estimated that few would attempt it now.

Furthermore, some comments pointed out that the wallet track is already highly competitive, withBase App and others actively developing, andFarcaster still faces certain challenges. At the same time, the winner in the wallet track competition must correctly answer one question: What wallet functions do people really want? Piling on features may lead to feature bloat, ultimately making the wallet cumbersome.

In summary,Farcaster's pivot is driven by harsh market data and pragmatic execution. It reveals the essence of the current SociFi track and sets a key tone: pure Web3 social may be difficult to succeed; it requires high-value, high-frequency financial tools as an entry point, and content-driven financialization mechanisms as the core of network stickiness and value沉淀 (precipitation/sedimentation).

Click to learn about ChainCatcher's open positions